What is mobile phone insurance?

Mobile phone insurance is a way of insuring your mobile phone in the event that your phone gets lost, stolen or damaged. It also provides protection from the expense of replacing or repairing a mobile phone. Here's a video to explain.

Do you need mobile phone insurance?

Mobile Phone Insurance is not just for the clumsy and accident-prone, all of us can relate to that feeling of dread when you drop your mobile phone and hope there is no damage.

The cost of repairing or replacing your mobile phone can be expensive especially if you like staying up to date with the latest models.

1000’s of people benefit from having mobile phone insurance. It is a really easy way of protecting you from the costs of repair or even worse, replacing a mobile phone and any accessories lost or damaged at the same time.

How much does phone insurance cost?

The cost of mobile phone insurance varies and is based on the overall cost of your phone. Generally, newer mobile phones cost more than an older phone and this is reflected in the cost of the insurance.

You will normally have the option to pay for your insurance through a monthly rolling subscription, or an upfront annual payment. Annual payments can sometimes prove to provide better value over the course of a full year, so make sure to check.

It's important when comparing insurance quotes to consider the level of cover you are looking for, and then any excess fee you will need to pay when making a claim. Be aware that some companies will also charge a supplementary excess if you claim within a few months of taking out your insurance policy.

The table below shows a selection of mobile phones from different manufacturers and a typical starting cost for our insurance, based on our middle excess and against accidental damage and breakdown.

Mobile Phone |

Monthly Premium |

Annual Premium |

| iPhone 14 (128GB) | £5.99 | £59.90 |

| iPhone 13 (128GB) | £5.99 | £59.90 |

| iPhone 12 (64GB) | £5.99 | £59.90 |

| Samsung S21 (128GB) | £5.99 | £59.90 |

| Samsung S22 (128GB) | £5.99 | £59.90 |

| Samsung Galaxy Z Flip 3 (128GB) | £7.49 | £74.90 |

| Google Pixel 5 | £8.99 | £89.90 |

| Apple iPhone 12 Pro Max (128GB) | £7.49 |

£74.90 |

Prices are correct at the time of publishing - January 2024

Want to know how much it will cost to insure your mobile phone?

What type of phone insurance do you need?

Choosing the right type of mobile phone insurance is straightforward. You will usually have a choice of plans with different cover levels which provide varying degrees of protection for your phone.

Mobile insurance policies which provide the highest levels of cover will cost the most, but it’s important that you choose a level of protection that suits you.

You can compare our phone insurance plans in the table below:

Compare Phone Insurance

Top-end mobile phones can be expensive so lots of people consider the option to insure their phone. We've done some of the hard work of comparing several ways you can insure your mobile phone here in the UK. We hope this will help you make a more informed decision on which policy is right for you.

What can affect the cost of mobile phone insurance?

-

Policy excess

Our policies have a set policy excess amount payable in relation to any claim made. This allows us to ensure that your premiums for cover remain as competitive as possible.

-

The model of phone

It wouldn't make sense to charge the same premium for a top of the range iPhone and a 3 year old Nokia - so we don't! The storage size could also have an impact.

-

Policy term

Usually, it is cheaper to pay 12 months upfront than one month at a time. This is true with our policies too, so make sure to take a look at both when you get a quote.

-

Insurance Premium Tax

No matter who you buy your mobile insurance from, all premiums will have 12% added for tax purposes.

-

Cost of repairs and replacements

The cost of repairing or replacing a newer model of handset is higher due to parts and replacement costs. The premium amount you pay will always take into consideration your specific phone.

-

What you are covered for

Your premium amount will vary dependant on the level of cover you chose. Optional cover such as theft and loss cover will increase the amount that you pay for your premium.

What mobile phones can you insure?

You can insure most major brand of mobile phone, including iPhone, Samsung, Google and Oppo. What is important is how old you mobile is? You cannot insure a mobile phone that is over 3 years in age.

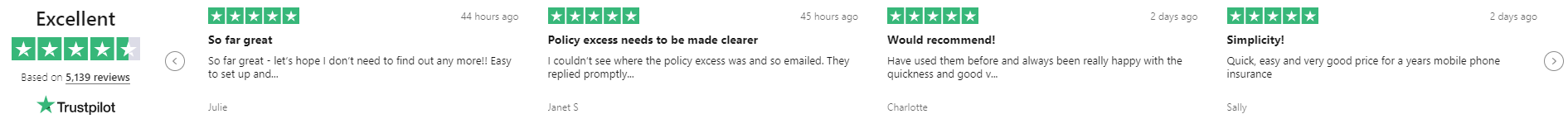

Why insure your mobile phone with insurance2go

-

Instant cover

Whether you buy a monthly or annual policy you’re covered from the moment you buy

-

Any make, any model up to 36 months old

We insure any phone bought new or refurbished from a UK registered company

-

Unlimited claims

Accidents happen, so that's why there's no limit to how many claims you can make

-

95% of claims accepted

You won't have to bend over backwards to prove your claim. In 2022, we approved 95% of mobile phone insurance claims*.

-

Here since 2007

We were one of the first businesses to provide specialist insurance for mobiles and gadgets

-

Flexible insurance plans

Choose to pay for a year upfront, or pay on a rolling monthly basis